Managing payroll can be a headache for small business owners.

But what if there was an app that made it easy?

In 2024, Hourly promises to make payroll simple, save time, and reduce stress.

Is it the right choice for your business?

Let's find out.

What is Hourly?

Hourly is an app used by businesses for payroll processes. It lets employers track hours worked, calculate payroll taxes, and manage deductions.

Employees can onboard themselves, view pay stubs, and adjust their payroll accounts through the app. Managers can track timesheets, upload and manage documents, and handle compliance with tax laws.

This tool is accessible via phone and web, so it's good for both on-the-go and office-based operations. It includes a document control center for managing employee documents and forms.

Customer support is available through a dedicated customer success manager. What's more, there's a 90-day money-back guarantee if it doesn't meet your business needs.

Top Hourly features - payroll hours & more

Quick overview: Key features include the ability to run unlimited payrolls, process payments for both W-2 and 1099 employees, and provide digital pay stubs.

The app also integrates time tracking, so companies get to monitor employee hours and locations in real-time. Additionally, Hourly handles payroll taxes and offers workers' compensation insurance.

Now let's take a look at these functionalities in more depth:

Unlimited payroll

One of the standout features of Hourly is its unlimited payroll capability. This means you can run payroll as often as needed without any extra charges. Whether you have a weekly, bi-weekly, or monthly schedule, Hourly makes it simple to get your team paid on time.

The payroll process can be managed through the mobile app, so it's convenient to handle even when you’re on the go.

Payment processing

Hourly supports payments for both W-2 and 1099 employees. This flexibility is great for businesses with diverse teams. You can easily manage hourly rate-based payments, whether you're handling full-time staff or freelancers. The app handles direct deposits, so your employees get their money quickly, without the hassle of paper checks.

Time tracking

Time tracking is nicely integrated into Hourly, so you get to keep a close eye on hours worked by your team.

The solution lets you monitor where and when your employees are working in real-time. This helps prevent time theft and even supports accurate payroll calculations. No more manually adding up hours at the end of the pay period.

Payroll taxes

Dealing with payroll taxes can be a headache, but Hourly takes care of it. The app calculates and syncs all the necessary payroll taxes for the best accuracy and compliance with local, state, and federal regulations. This feature saves you time and lowers the risk of errors.

Workers’ comp integration

Hourly also integrates workers' comp insurance into its payroll software. Your workers' comp premiums are calculated based on real-time payroll data. The app keeps track of everything, so you don't have to worry about manual calculations or year-end audits.

Employee self-service

Employees can use Hourly to onboard themselves, check their pay stubs, and manage their accounts. This self-service feature saves time for both managers and employees, reducing the back-and-forth typically associated with payroll inquiries. It's pretty user-friendly.

Digital pay stubs

No more paper clutter with Hourly’s digital pay stubs. Each pay period, employees receive digital pay stubs directly through the app. This feature not only saves paper but also makes it suitable for employees to access their payment history anytime they need it.

Document management

Managing employee documents is hassle-free with Hourly. It has a document control center where you can store and manage important files like W-4s, employee handbooks, and more. You can send documents to employees for e-signatures and keep everything organized.

PTO and overtime management

Tracking paid time off (PTO) and managing overtime is simple with Hourly. You can set rules for minimum lunch breaks and require manager approval for overtime hours. This helps your team follow company policies and stays within labor law requirements.

Hourly payroll - customer reviews

These features seem nice and solid, but what is the reality?

User reviews will tell you everything:

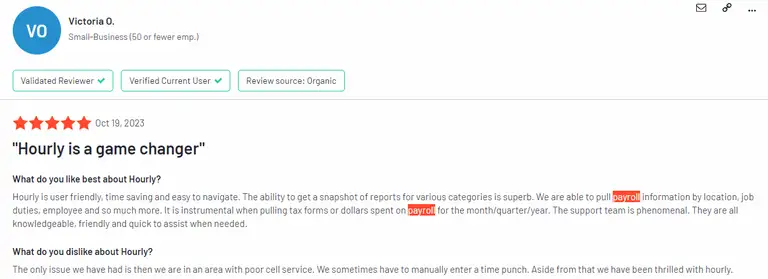

Ease of use

Many users appreciate how user-friendly Hourly's payroll feature is. For instance, Victoria O. highlighted the app's pleasant navigation and ability to pull payroll information by location, job duties, and employees. She finds the support team knowledgeable and quick to assist when needed. Rebecca K., a payroll specialist, also praised the app for being user-friendly and easy to navigate.

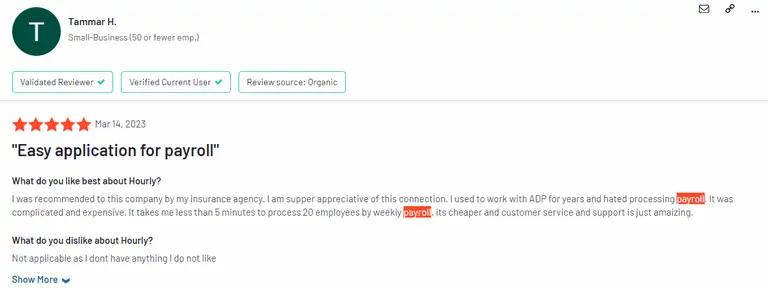

Time-saving

Hourly’s payroll feature is often praised for its performance. Tammar H., who processes payroll for 20 employees bi-weekly, noted that it takes her less than five minutes. Deshaun D. thinks the app is not difficult to maneuver even for those who are not tech-savvy.

Integration with workers' comp

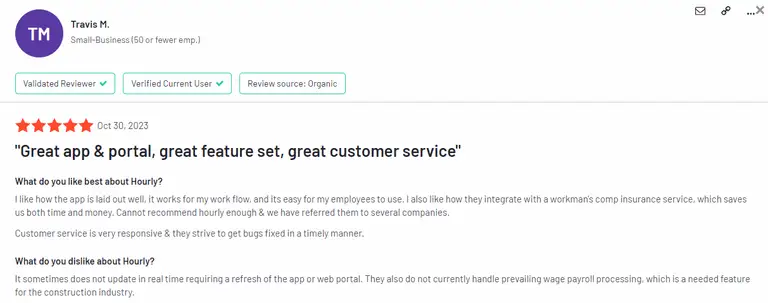

Hourly’s integration with workers' comp insurance is a notable benefit. Travis M. from a small business pointed out that this integration saves both time and money. He appreciated how the app and portal fit into his workflow and found it trouble-free for his employees to use. This seamless integration with workers' comp is a unique feature that sets Hourly apart from other payroll software.

Customer support

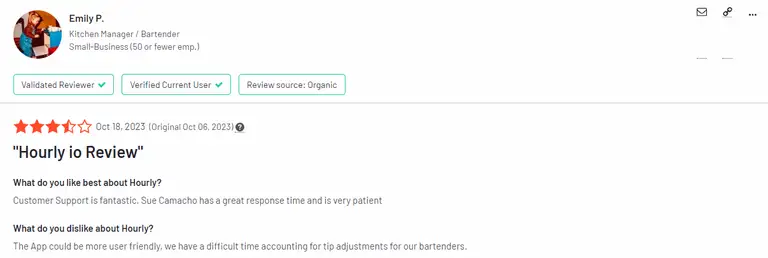

Customer support is frequently mentioned in positive reviews. Emily P. particularly appreciated Sue Camacho’s quick response time and patience. Ken T. also highlighted the helpful and responsive customer support team, which adds to the overall positive experience with Hourly.

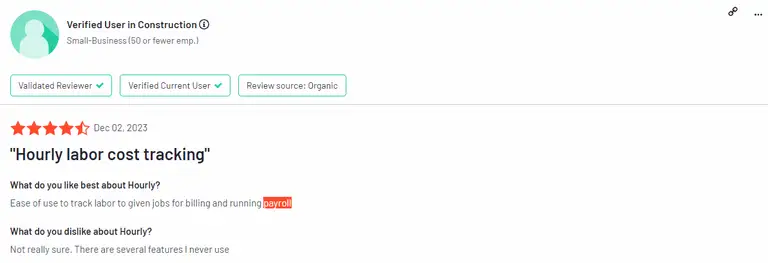

Reporting and customization

While many users find Hourly’s reporting features useful, some have noted areas for improvement. For example, a user in the construction industry mentioned that some features are never used. What's more, a few reviews, like that of Travis M., suggest that real-time updates sometimes require a refresh.

Pricing

Hourly offers three main pricing plans: Gold, Platinum, and Platinum+.

- Gold Plan: this is the basic plan and includes features like direct deposit, automated tax payments, and time tracking with GPS.

- Platinum Plan: this service includes everything in the Gold Plan plus additional features like same-day direct deposit, employee onboarding, and access to HR experts.

- Platinum+ Plan: the top-tier option includes all the features of the Platinum Plan, along with dedicated customer success team support and more advanced HR services.

Hourly charges a monthly fee, starting at $80 per month plus $12 per employee. The specific prices for the Platinum and Platinum+ plans are not provided on the website, but they include more advanced features compared to the Gold Plan.

With each plan, you can run payroll as often as needed, so you only pay for active users - those who record at least one shift or get paid once a month. This makes managing your payroll account a piece of cake, saving you time and effort when paying your team.

Who is Hourly for?

Hourly can be great for many types of businesses.

Here are some that can really benefit:

- Small businesses

Small businesses often find payroll difficult. Hourly makes it easy to calculate pay and taxes. It’s perfect for owners who want to save time and money.

- Construction companies

Construction companies have both full-time workers and freelancers. Hourly handles both W-2 and 1099 payments well. It also tracks hours worked on different sites.

- Restaurants and hospitality

Restaurants and hotels deal with changing schedules and high turnover. Hourly’s time tracking and digital pay stubs help manage this. Employees can track their hours and tips.

- Retail stores

Retail stores have employees working different shifts. Hourly tracks all hours worked. This reduces mistakes and keeps employees happy.

- Healthcare services

Healthcare providers have staff working irregular hours. Hourly’s time tracking and direct deposit features make payroll seamless for nurses and aides. It also helps with complex payroll taxes.

- Professional services

Consulting firms and agencies can manage both hourly and salaried employees with Hourly. The app’s document management helps handle contracts. Real-time labor cost tracking aids in project management.

- Seasonal businesses

Seasonal businesses like landscaping or holiday shops can use Hourly’s flexible payroll. The software handles changing employee numbers and hours worked during busy seasons.

Better payroll service is here

For those looking for other options, Unrubble is another payroll service worth considering. Unrubble offers time tracking, scheduling, and PTO management, all aimed at reducing paperwork and making your workday smoother.

It's packed with features like:

- Precise time tracking: track your team’s hours with spot-on accuracy. This helps in counting overtime, tracking lateness, and even reconciling work time discrepancies effortlessly.

- Scheduling: Unrubble simplifies work scheduling with tools for copying, pasting, and drag-and-dropping schedules. Real-time notifications keep everyone in the loop.

- PTO management: manage requests for time off, work-from-home days, and business trips easily. Employees can handle their own PTO requests.

- Mobile Time Clock: with features like face recognition and anti-spoofing, employees can clock in and out securely from their mobile devices.

- Employee Self-Service App: our app lets employees manage their schedules, track hours, and handle work requests right from their phones.

Both Hourly and Unrubble are awesome tools to manage payroll and employee hours. Trying these options can help you find the best fit for your business needs.

Choose your favorite and get started today.