Welcome to the world of payroll management, where every minute counts and precision is key.

In this comprehensive guide, we're looking into the nitty-gritty of tracking and calculating employee hours.

Whether you're a seasoned payroll professional or new to the game, this article will help you go through the payroll process, step by step.

Why track employee hours for payroll?

For many businesses, tracking hours for payroll is a necessity rather than an option. But maybe you want to know the real reason why accounting tracks hours. Here are some of them.

Be fair and square

Think of each employee as having their own 'scoreboard' that shows how much they've worked. This is where you track hours. It's like keeping a tally of every minute they're on the job.

This ensures that you’re paying each employee fairly, according to the hours they worked in a month.

Keep numbers right

Now, let's talk about calculation. This is where the math gets a bit complicated but stay with us.

Every employee has a pay rate, which is the value of each point in our game. This rate is usually a 'per hour' thing. So, if someone's pay rate is $15 per hour, and they work for 2 hours, they've earned $30.

Stay accurate

But here's a twist – not everyone works exact hours. Someone might work for 2 hours and 30 minutes. This is where we convert the minutes into a fraction of an hour. So, 30 minutes becomes 0.5 hours. This way, we can calculate time accurately and make sure everyone gets paid exactly what they've earned.

In a nutshell, tracking hours is all about making sure every employee who works gets paid the right amount. It's a mix of being precise with time, doing a bit of math, and ensuring everyone's happy at the end of the day when they receive their paycheck. It's a system that keeps things fair and clear for everyone involved.

How to calculate hours worked for payroll: our payroll calculation guide

Now, let us show you how you can do this all by yourself in 10 steps.

Step 1: gather employee information

Kick things off by collecting all the necessary details. You need to know each employee's name and their specific employee hours. This is the foundation for everything that follows.

Expert tips:

- Use a time card system: implement a time card system to accurately record when each employee worked. This makes gathering information much more efficient.

- Digital records: consider digitalizing employee records for easier access and management.

- Regular updates: check whether employee information is regularly updated to reflect any changes in roles or hours.

Step 2: determine the pay period

Decide on the pay schedule. Is it weekly or monthly? This step sets the rhythm for when you'll calculate payroll hours.

Expert tips:

- Consistency is key: stick to a consistent pay schedule, whether it's weekly or monthly, to avoid confusion.

- Communicate clearly: make sure employees understand the pay period structure.

- Align with business cycles: choose a pay plan that aligns well with your business's financial cycles.

Step 3: calculate the hours worked

Now, it's time to calculate the hours of work. This means adding up all the time each employee has clocked in during the pay time. It's a bit like putting together a puzzle, making sure every piece fits.

Expert tips:

- Time clock accuracy: use a reliable time clock system to track when employees start and end their shifts.

- Divide the minutes by 60: when calculating hours, remember to divide the minutes by 60. For example, if an employee has worked for 2 hours and 15 minutes, that's 2.25 hours.

- Regular audits: periodically audit the hours logged to stay accurate and prevent discrepancies.

Step 4: calculate overtime (if applicable)

Here, you'll need to calculate working hours that go beyond the standard 40 hours per week. Use a calculator to accurately tally these overtime hours, converting all hours and minutes into the right format.

Expert tips:

- Clear overtime policy: have a clear policy on overtime and communicate it to all employees.

- Monitor overtime trends: keep an eye on overtime trends to manage staffing needs better.

- Automate Calculations: use software that automatically calculates overtime to reduce errors.

Step 5: calculate additional earnings

This step involves adding any extra earnings to the total hours worked. It's like giving a bonus for good performance.

Expert tips:

- Transparent criteria: set clear criteria for additional earnings like bonuses or commissions.

- Regular reviews: review and update the additional earnings structure regularly to keep it relevant.

- Employee input: consider employee feedback in structuring additional earnings.

Step 6: calculate deductions

Subtract any deductions from the total number of hours worked. This includes taxes and other withholdings. You'll need to consider the start and end time of each shift, as well as the total number of hours worked.

Expert tips:

- Stay updated on regulations: keep abreast of tax laws and regulations to make accurate deductions.

- Employee education: educate employees about the nature of deductions from their pay.

- Use reliable software: employ payroll software to automate and simplify the deduction process.

Step 7: verify compliance

Check whether the total hours comply with all relevant labor laws. It's a quality check to verify that everything is in order.

Expert tips:

- Regular legal checkups: regularly consult with a legal expert to stay compliant with labor laws.

- Employee work hours audit: conduct audits of employee work hours for compliance.

- Training sessions: hold training sessions on compliance for staff handling payroll.

Step 8: generate payroll reports

Now, create reports that detail the payroll hours. These reports are crucial for transparency and record-keeping.

Expert tips:

- Detailed reporting: pay attention to whether payroll reports are detailed and include all necessary information.

- Easy access for employees: make payroll reports easily accessible to employees for transparency.

- Use analytics: utilize analytics to gain insights from payroll reports for better decision-making.

Step 9: process payments

The moment everyone's been waiting for – processing payments based on the hours worked and calculations done.

Expert tips:

- Timely payments: always process payments on time to keep employee trust and satisfaction.

- Multiple payment options: offer various payment options to accommodate different employee preferences

- Payment confirmation: send out payment confirmations to employees for their records.

Step 10: keep accurate records

Finally, make sure to keep accurate records of all your calculation processes. This is essential for future reference and maintaining compliance.

Expert tips:

- Digital record-keeping: use digital systems for efficient and accurate record-keeping.

- Regular backups: regularly back up payroll records to prevent data loss.

- Access control: limit access to payroll records to authorized personnel only for security.

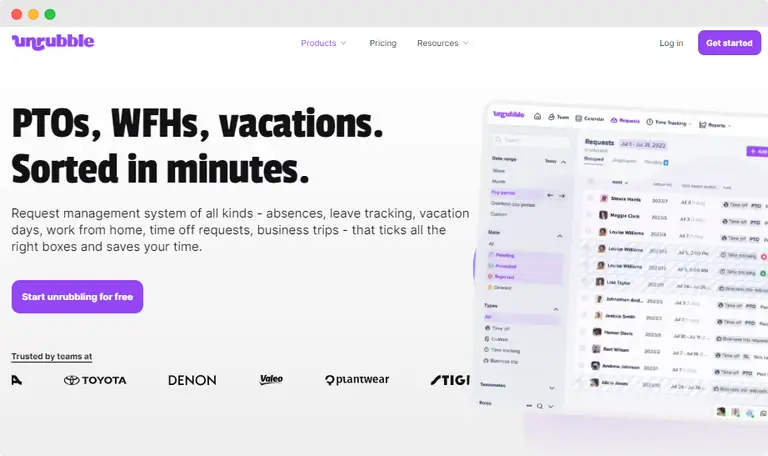

Automate all this with Unrubble payroll software instead

You know those 10 steps we just talked about for calculating hours worked for payroll?

Well, Unrubble can streamline all of that into one smooth process.

Let's talk about how Unrubble payroll software can make your life a whole lot easier when it comes to managing payroll:

Gathering employee information and determining pay periods

With Unrubble, you don't have to manually collect employee information or figure out pay periods. The software does it for you. It's your smart assistant who knows exactly who worked when and for how long.

Calculating hours worked

Remember the hassle of calculating hours, especially those tricky overtime hours? Unrubble's got you covered.

It uses time tracking and timesheets to automatically record and calculate all the hours an employee worked. This includes regular hours, overtime, and even breaks. It's a super-efficient timekeeper.

Calculating additional earnings and deductions

Unrubble isn't just about tracking hours. It can also handle additional earnings and deductions. Whether it's bonuses, PTOs, commissions, taxes, or retirement contributions, Unrubble calculates it all seamlessly.

Compliance and reporting

Are you worried about staying compliant with labor laws? Unrubble helps verify that all the total hours worked are within legal limits.

Plus, it generates detailed payroll reports, so you have all the information you need right at your fingertips.

Processing payments and keeping records

Finally, when it's time to process payments, Unrubble makes it a breeze. And as for keeping records, you can say goodbye to piles of paperwork. Unrubble stores everything digitally, making it easy to access and manage.

In short, Unrubble is the one for all your payroll needs. It takes care of everything from tracking time to processing payments, all while being super user-friendly.

So, instead of juggling multiple tasks and calculations, you can just sit back and let Unrubble handle the heavy lifting. It's payroll management made easy. Start time tracking and more today - sign up and use for free.

Calculating payroll hours made easy

And there you have it – a complete journey through the landscape of payroll hours.

From understanding the importance of tracking hours to mastering accurate counting, we hope this guide has equipped you with the knowledge to streamline your payroll process.

Remember, payroll accuracy not only ensures fair compensation. It also fosters trust and transparency within your organization.

So, embrace these insights, apply these expert tips, and consider the wonders of Unrubble to transform your payroll experience.