There are many ways to tell if a project was successful: happy customers, improved products or services, ecstatic employees, quicker product delivery… But most of all, what matters is how profitable a project is. But how do you determine that?

Measuring project profitability (and improving it) is much more than just tallying up how much you’ve earned. Today, we’ll show you how to do a successful project profitability analysis and improve the profitability of your future projects.

But first of all…

What is project profitability?

Project profitability is a measure of how efficiently a project is producing value. It can be thought of as the return on investment (ROI) of a project.

ROI is a critical metric for businesses. It can help determine the profitability of a project, help make business decisions about whether to continue a project and help identify issues with a project early on.

There are a number of factors that can affect a project’s profitability, including:

- Amount of value produced

- Project costs (employees’ hourly rates, material costs, etc.)

- Time taken for the project.

- Quality

- Efficiency

When doing your project profitability analysis, it’s important to consider all of these aspects to find out the actual cost of your finished project.

How does project profitability work?

There are a number of ways to measure project profitability. The most common methods are:

- Return on investment (ROI)

- Earnings before interest, taxes, depreciation & amortization [EBITDA]

- Net present value (NPV)

These metrics can be used to assess the profitability of a project on a relative or absolute basis or to compare the profitability of different projects.

Return on investment (ROI) is the most common measure of project profitability. It measures how much value the project produces relative to the costs of the project.

ROI can be calculated using a number of different methods, including:

- Internal rate of return (IRR)

- Return on assets (ROA)

- Payback period

EBITDA is another common metric for project profitability. It measures how much money the project generates before accounting for costs associated with the project.

EBITDA can be calculated using a number of different methods for individual projects, including:

- Gross profit

- Operating income

- Net income

- Net cash flow

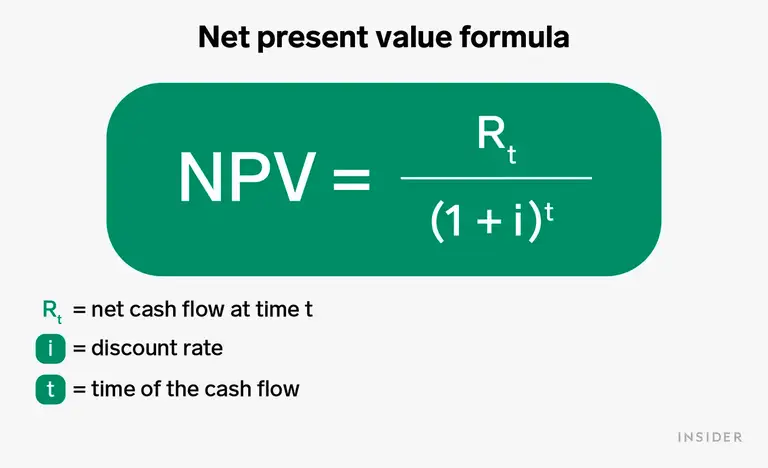

NPV is another measure of project profitability. It measures the value of a project after accounting for all costs associated with the entire project, including financing costs.

You can calculate NPV using a number of different methods, including:

- Internal rate of return (IRR)

- Net present value (NPV)

- Payback period

Which of these metrics works the best for your project profitability reports? It does not really matter as each will provide a useful number to work with. However, ROI is the most commonly used metric for most businesses minding their project budget.

How to calculate project profitability

When calculating a business's profitability, there are a few key factors to consider. Going through each one will help create more profitable projects so it’s worth doing the whole procedure with each new project.

1. Identify your key revenue and expense drivers

The first step in calculating project profitability is identifying your key revenue and expense drivers. This will help you determine which areas of your business are most impacted by your projects.

For example, if your business relies heavily on marketing efforts to generate revenue, you'll want to make sure those project costs are included in your calculations. Likewise, if your project expenses include a lot of labor costs, you'll want to factor that in as well.

It’s useful to take a look at billable hours at this point too. Traditionally, billable hours were pretty difficult to calculate, but with modern time tracking apps such as Unrubble, this is a breeze. With all of your employees and contractors using Unrubble, you’ll not only deliver the project on time but also have real time access to who’s working on what. Moreover, you’ll have a laser-precise overview of your billable expenses.

2. Calculate your break-even point

You need to calculate your break-even point next. This is the point at which your business becomes profitable based on your current standard operating procedures.

To calculate your break-even point, you'll need to calculate your total cost of goods sold (TCOGS). This will include the cost of materials, labor costs, and overhead costs. You'll also want to include any marketing or promotional costs associated with your products or services.

3. Estimate your gross margin

With your TCOGS, you can estimate your gross margin. Project margins determine the percentage of your sales that remain after you've taken into account your costs of goods sold and any applicable taxes.

In other words, these are your financial gains after calculating all costs.

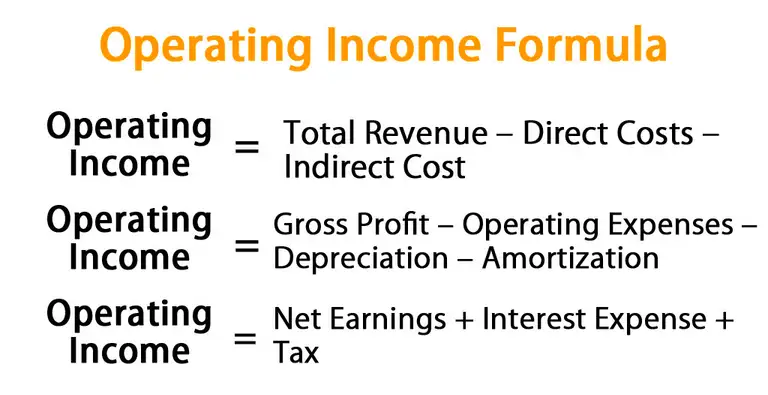

4. Calculate your operating income

Your gross margin is also important in calculating your operating income. This is the total amount of money your business makes after taking into account all of its expenses.

To calculate your operating income, you'll need to subtract your total expenses from your total revenue.

5. Arrive at your net income

This is the total amount of money your business makes after taking into account all of its expenses.

Subtract your total expenses from your total revenue for your net income.

6. Get your return on investment (ROI)

Then calculate your business's return on investment. This is the percentage of your net income that's returned to you as a return on your investment.

Divide your net income by your total assets to calculate your return on assets and track project profitability.

7. Calculate your debt-to-equity ratio

Another important measure of business profitability is your debt-to-equity ratio. This measures how much debt your business has compared to the equity it has in its assets.

A high debt-to-equity ratio indicates that your business is likely in trouble. It's important to take this into account when making decisions about your future.

8. Evaluate your cash flow

To calculate your cash flow, you'll need to subtract your total liabilities from your total assets.

9. Calculate your profitability

Now that you've calculated your key measures of business profitability, it's time to put it all together and reach your project profits. To do this, you'll need to calculate your net income, return on assets, and return on investment.

10. Project profitability index formula

Just divide the present value of all your future project cash flows by the initial investment you made in the project. Profitability Index = Net Present value + Initial investment / Initial investment.

Once you have these figures, you can use them to make informed decisions about your business's future. With all of these numbers in place, you can create comprehensive project profitability reports, no matter what industry or niche you’re in.

Ten effective ways of increasing project profitability

Now that you know how to assess your potential profitability, it’s time for some practical advice on how to improve it.

Establish realistic expectations.

Don't expect your project to be a money-making machine from the get-go. Successful project managers take the time to learn about their project's unique capabilities and limitations. This knowledge will help them set realistic goals and expectations all the way from the initial project plan.

Define workflows early on.

Once you know the basics of your project, you'll need to create a feasible workflow to manage it. This will help you stay organized and on track, and minimize surprises.

Create a realistic budget.

Creating a budget is key to controlling your project's expenses. Make sure to account for all costs, including salaries, materials, project profitability software, and overheads.

Prioritize tasks.

When you have a clear understanding of your project's goals, it's easier to determine which tasks need to be completed first. This will help you stay on track and avoid wasted time and resources.

Stay organized.

Keeping your project files and folders organized will make it easier to find information when you need it. This will also help you avoid wasting time on needless tasks.

Communicate frequently.

By informing your project team about progress and changes, you can maintain a successful project. This way, everyone is aware of what's happening and can make appropriate adjustments.

Control costs.

One of the best ways to save money on your project is to control costs. This means finding ways to cut corners where possible to get maximum cost savings.

Follow the project timeline.

Keeping to a strict timeline will help you avoid delays and avoid costly overruns.

Use quality resources.

When it comes to resources, choose quality over quantity for long-term savings.

Monitor project performance.

Periodically conducting project profitability analysis will help you identify any areas of concern. This will help you make necessary corrections and keep your project on track.

Wrapping up

Staying on top of your project profitability is the first step to becoming more profitable in the future. If all the calculations seem complex, the good news is that it gets easier with every new project.

And if you want to make sure your profitability calculations are correct, you need accurate time tracking. At Unrubble, we created a time tracker that works for businesses like yours. We’ll make sure you keep tabs on your billable hours so you can make accurate predictions about future projects.

Sign up for your free trial to get started today!

Frequently asked questions

What is the best way to measure productivity?

As explained above, there are three main ones that you can use as a starting point. ROI would be the best metric for anyone starting with project profitability analysis.

What is a good project profit margin?

It depends on many factors, mostly the industry you work in. However, a margin of around 20% or so is genuinely considered good, while anything around 5% is considered bad.

How do I increase the profitability of a potential project?

There are plenty of steps to go through. However, it’s crucial to set your profit expectations early on, set aside a budget for the project and constantly review your bottom line performance.