How many pay periods are in a year? It’s one of those questions that sounds simple but comes with many angles.

For employers, the answer shapes payroll costs, cash flow, and even administrative workload.

For employees, it impacts how often they see money in their account and how they handle immediate expenses like rent or mortgage payments.

In 2026, payroll management will continue to evolve, and companies are rethinking their schedules to balance both business needs and employee preferences.

Understanding the number of pay periods in a year

The number of paychecks in a year depends on the company’s pay period frequency.

A weekly pay schedule gives 52 paychecks.

Biweekly pay periods create 26, or sometimes 27 if calendar dates align.

A semi monthly pay schedule means 24 paychecks, while a monthly pay period delivers 12.

Each choice has trade-offs.

More frequent pay periods can support employees with short-term expenses but increase payroll costs and the administrative burden.

A monthly pay schedule keeps payroll services leaner but may feel long for hourly employees who rely on prompt payments.

Salaried employees tend to adapt more easily, as their annual salary stays the same regardless of pay period length.

Access our free employee schedule template here.

What is a weekly pay period?

A weekly pay schedule means employees are paid every week, usually on the same weekday. That adds up to 52 pay weeks in most years.

For businesses, weekly schedules make it easier to track employee hours and overtime pay, especially under the Fair Labor Standards Act. Hourly employees often prefer this approach because frequent payments match daily living costs.

At the same time, weekly payroll increases administrative work and payroll costs. Organizations using payroll services need to weigh this against the benefit of prompt payments and employee satisfaction.

Weekly schedules may not be the best pay period for salaried employees, who don’t need frequent payments to balance budgets.

Read also: Salary vs hourly pay rate: pros and cons.

How a biweekly payroll calendar works

A biweekly pay schedule pays employees every two weeks on the same day, such as every other Friday. This results in 26 paychecks most years, but sometimes calendar dates align in a way that creates an extra pay period, giving 27. That additional pay period can affect both payroll costs and tax deductions.

Biweekly schedules are common in the United States because they strike a balance between frequent payments and administrative efficiency.

Hourly employees benefit from consistent paychecks, while salaried employees see their annual salary divided into regular payments.

Still, employers must account for the third payroll that appears in some years, which can change cash flow planning.

Monthly payments vs. other pay period types

A monthly pay period means employees are paid once a month, giving 12 paychecks per year. This schedule works well for salaried employees who plan around a steady monthly paycheck. It can also reduce the number of payroll runs for the business.

Other pay period types bring different results.

Semi monthly pay periods, with 24 checks per year, are close to monthly but give employees more frequent payments.

A bi weekly pay period creates 26 checks, and in some years, either an additional paycheck appears, raising the number to 27.

Weekly schedules are the most frequent, with 52 paychecks.

Each type of pay period comes with trade-offs between employee preferences and the company’s resources.

Read also: Semi-monthly vs bi-weekly pay plan.

How pay schedule affects your company’s cash flow

The choice of pay frequency has a direct impact on cash flow.

A monthly paycheck system requires larger payouts at once, which can stress company funds if revenue patterns are uneven.

Semi monthly payments spread costs more evenly across the month, while biweekly pay periods sometimes create months with three payrolls. That third payroll can feel heavy if cash flow is tight.

Weekly paychecks bring even more frequent withdrawals. For companies, this means higher payroll costs in terms of processing and immediate cash demands.

Choosing the right organization’s payroll schedule depends on how predictable revenue is and how well the company manages expenses.

Read also: Payroll 101 - the ultimate checklist.

And use: Free cash flow statement template.

The role of pay date in payroll processing

Beyond pay frequency, the actual dates matter.

When semi monthly pay periods are used, dates fall on the 15th and the last day of the month, or similar fixed points.

With a bi weekly pay period, the dates shift each year, which can create either an additional paycheck or a heavier load on payroll management.

Payroll services must also track how dates fall against weekends and holidays. If a payday lands on a Saturday, companies often move it earlier, adding another layer of planning.

These details influence not just how many paychecks employees receive, but also the company’s workload in payroll processing.

Payroll schedule options for employers

Employers have several types of pay periods to choose from: weekly, biweekly, semi monthly, or monthly.

Each option comes with a different number of paychecks in a year and a different impact on payroll costs.

Weekly and biweekly schedules are common for hourly workers, while salaried employees are often paid monthly or semi monthly.

Selecting an organization’s payroll schedule requires balancing employee preferences with financial planning.

More frequent pay periods give staff prompt access to earnings but can strain company resources. Less frequent schedules reduce payroll runs but may feel restrictive for employees covering daily expenses.

The best pay period for a business often depends on its size, industry, and how steady its income streams are.

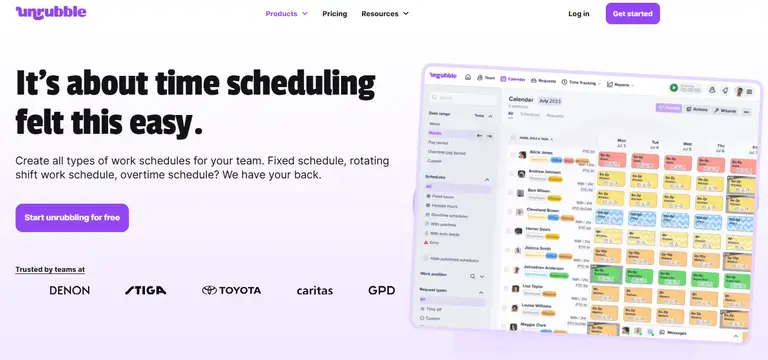

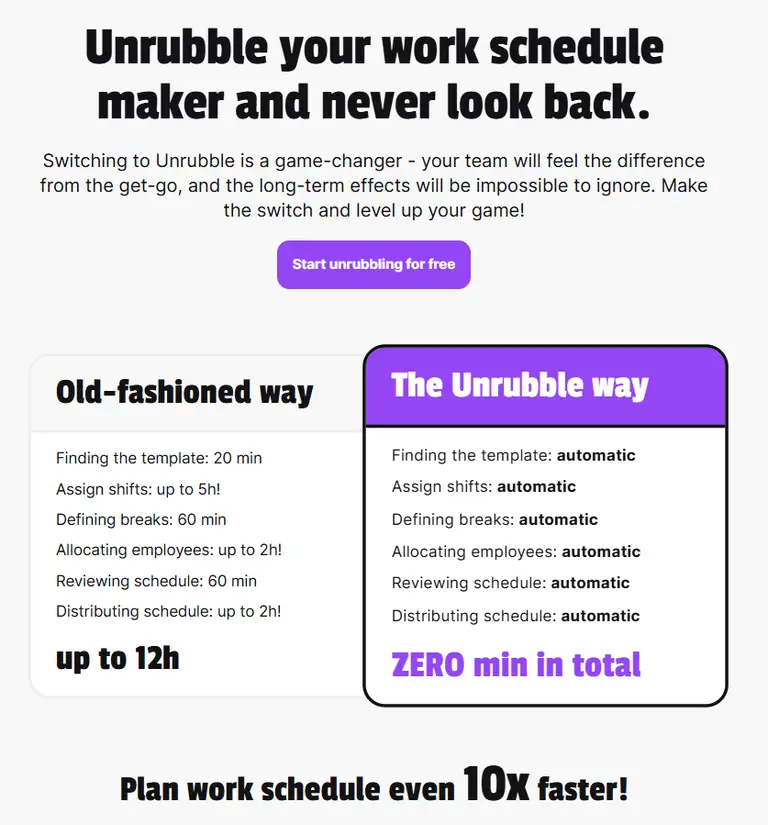

When choosing a payroll schedule, flexibility matters. That’s where tools like Unrubble come in. Unrubble helps track hours, attendance, and schedules in real time, so no matter which pay cycle you pick, payroll runs smoothly without the usual manual headaches.

Administrative costs of different pay cycles

Every pay period type carries its own level of administrative work.

Weekly and biweekly schedules mean more frequent payroll runs, which can increase costs for payroll services and staff time. Semi monthly and monthly cycles reduce the number of runs but may require extra checks when dates fall on weekends or holidays.

An organization choosing between different pay schedules needs to weigh not only payroll costs but also the time spent tracking hours, overtime, and deductions. Frequent pay cycles can bring more accurate records, while longer cycles may cut the workload but risk bigger corrections later.

Administrative costs rise when payroll teams spend hours fixing timesheets or chasing attendance records. Unrubble cuts down on this workload by automating time tracking and scheduling. Instead of paying extra for mistakes or delays, businesses keep payroll accurate from the start and save on admin costs in the long run.

Impact of payroll taxes on pay periods

Payroll taxes are tied to every paycheck. With more frequent pay periods per year, tax deductions happen more often, though the total amount remains the same over twelve months.

For example, employees on a weekly cycle see smaller deductions spread across 52 checks, while those paid monthly see larger deductions in each paycheck.

Different pay periods can also influence reporting requirements for employers.

A third payroll in a biweekly year can increase administrative tasks, even if the total annual salary doesn’t change. Keeping payroll taxes aligned with the company’s schedule is key to staying compliant.

Choosing the right pay period type for your business

Picking the best payroll schedule depends on balancing financial stability with employee needs.

Smaller firms may prefer monthly or semi monthly schedules to reduce payroll runs. Larger companies with many hourly staff often use biweekly or weekly pay to keep up with hours worked and overtime.

No single schedule fits all. The decision comes down to cash flow patterns, industry standards, and how much administrative capacity the business has.

Testing different pay schedules can help leaders see which option works best over time.

Over to you

So, how many pay periods in a year? It depends on the cycle you choose.

Weekly means 52, biweekly brings 26 or 27, semi monthly adds up to 24, and monthly settles at 12. Each option carries trade-offs between cash flow, payroll costs, and employee expectations.

For employers, the right schedule is the one that balances company resources with fair and timely pay.

For employees, it shapes how steady income feels month by month.

As you plan your organization’s payroll schedule for 2026, think about both sides of the equation and make the process easier with Unrubble. With smart time tracking, scheduling, and payroll-ready data, Unrubble helps you keep every cycle accurate and stress-free. And the best part? You can get started for free.

![How To Evaluate HR Transformation Effectiveness [2026 Guide]](/static/image?src=https%3A%2F%2Fcdnblog.unrubble.com%2Fpayload-unrubble-images%2FUnrubble-how-to-evaluate-hr-transformation-effectiveness-2026-guide-180x120.jpg&width=128&height=128&fit=cover&position=center&quality=65&compressionLevel=9&loop=0&delay=100&crop=null&contentType=image%2Fwebp)