Many working Americans are asking if overtime earnings will be free from payroll taxes. Before 2025, overtime wages were taxed the same as regular pay.

Federal income tax, Medicare taxes, and Social Security all applied to overtime earned in any tax year. That changed with the One, Big, Beautiful Bill Act, signed into law on July 4, 2025.

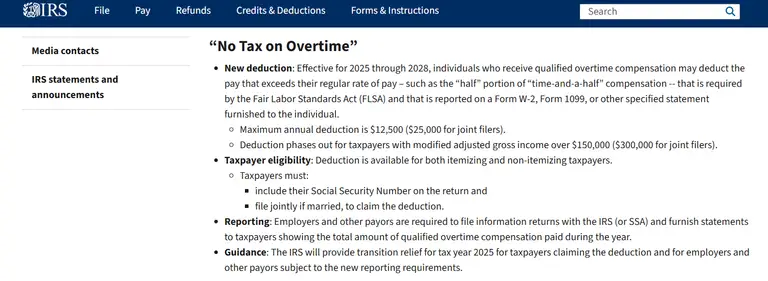

From 2025 through 2028, eligible workers can deduct part of their overtime earnings from taxable income. The deduction covers the “half” portion of time-and-a-half pay required by the Fair Labor Standards Act (FLSA).

This new rule does not erase payroll taxes like Social Security or Medicare, but it does reduce taxable income for federal purposes.

Read on to find out more.

Overtime pay and how it is taxed

Overtime wages count as extra income. Every hour worked above 40 in a week is overtime hours. Employers calculate the regular rate, add the overtime premium, and withhold taxes. Workers still see deductions for Social Security, Medicare, and federal income tax.

What changed in 2025: the premium portion of overtime pay may be deducted at tax time. The limit is $12,500 for single filers and $25,000 for joint filers. Above income thresholds of $150,000 ($300,000 for joint filers), the deduction phases out.

Is overtime pay taxable under federal and state taxes?

Yes, overtime pay remains taxable, but now there is a federal deduction for part of it. State rules vary. Some states may mirror federal deductions, while others may not. Workers should check with tax professionals to confirm local treatment. Employers report overtime with other pay subject to withholding, and at year-end, the W-2 shows the total overtime amount.

Overtime deductions and common tax deductions explained

Overtime earnings are not fully exempt. The new deduction covers only the half-rate premium, not the base wage. To qualify, taxpayers must include their Social Security number on the return and file jointly if married. Employers are required to file information returns with the IRS showing the total overtime compensation. The IRS has promised transition relief for 2025.

Tax free overtime: myth or reality?

For years, the idea of tax-free overtime was a rumor. During President Trump’s term, proposals were floated but never enacted. Now, with the One, Big, Beautiful Bill Act, it’s partly a reality. Workers won’t pay income tax on the premium portion of overtime up to the annual deduction limit, but payroll taxes still apply.

Not all overtime is treated the same by the IRS

The IRS now treats qualified overtime compensation as deductible under the new law, but the same reporting requirements apply as for regular wages. Employers must continue to document total earnings, and taxpayers still need to include proper statements when filing. The deduction applies only to the overtime premium, and the IRS still requires complete reporting of all wages.

Understanding overtime bills and new tax proposals

Lawmakers had long debated tax breaks for overtime. Earlier proposals never passed. That changed in 2025 when the One, Big, Beautiful Bill Act became law. The Act introduced a federal deduction for the premium portion of overtime hours, setting income thresholds, joint filer rules, and reporting requirements for employers. The IRS has issued a fact sheet and will provide transition relief as the rules take effect.

The “Big Beautiful Bill Act” and what it means for overtime pay

The Big Beautiful Bill Act made the overtime deduction official. Workers can now claim up to $12,500 ($25,000 for joint filers) of overtime premium as a federal deduction, subject to income phase-outs. Employers must report total overtime compensation on W-2s or other statements. The IRS will continue publishing guidance and fact sheets to clarify reporting details.

How state taxes affect overtime work

While federal income tax applies to all overtime wages, state taxes vary.

Some states consider overtime earnings part of taxable income without special deduction phases.

Others have credits that help taxpayers claiming extra income.

Employers must watch local provisions and new reporting requirements.

Workers should check with tax professionals to see if their state has an overtime tax benefit or if overtime hours will push them over income thresholds.

Overtime start rules: when does extra pay qualify for taxes?

The Fair Labor Standards Act says eligible employees must be paid time-and-a-half for extra hours.

Overtime hours start after 40 in a week. From that point, qualified overtime compensation is counted as overtime wages.

Employers calculate the regular rate, add overtime earned, and then deduct Social Security, Medicare taxes, and federal income tax.

At tax time, reporting requirements apply to all workers, whether they are joint filers or single taxpayers claiming a tax return.

How does overtime tax work in other countries?

Overtime taxation is not the same everywhere. Each country has its own payroll rules, income thresholds, and deduction phases.

Here are some quick notes:

United Kingdom

Overtime wages are taxed as part of normal pay. Employers deduct income tax and National Insurance through PAYE. No special tax break for overtime hours.

Australia

Overtime earned is part of assessable income. Employers withhold tax under PAYG, including Medicare levy. No separate tax benefit, but extra income can raise tax rates.

Canada

Overtime compensation is taxable like regular wages. Employers deduct Canada Pension Plan (CPP) and Employment Insurance (EI) along with federal and provincial taxes.

France

Some overtime hours can be exempt up to a set limit. Workers may receive a partial tax break on overtime earned each tax year.

Germany

Overtime compensation is taxable under payroll taxes and social contributions. Employers deduct income tax, health insurance, and pension payments.

Japan

Overtime hours are taxed as part of total wages. Employers deduct income tax and social security. No separate provision for overtime.

India

Overtime wages are included in taxable salary income. Payroll taxes and income tax rates apply, with reporting requirements on the tax return.

United Arab Emirates

For most foreign workers, overtime is taxed only if the worker’s home country taxes global income. The UAE itself has no federal income tax on wages.

South Africa

Overtime pay is subject to PAYE deductions, including income tax and social security contributions.

Brazil

Overtime earnings are part of taxable salary. Employers deduct social security contributions and income tax at source.

Over to you

Overtime taxes have changed for the first time in decades. The premium part of time-and-a-half can now be deducted on your federal return through 2028, thanks to the One, Big, Beautiful Bill Act. Workers still pay Social Security and Medicare, and state rules may differ, but this new break makes overtime more rewarding.

Clear records are now more important than ever. That’s where Unrubble helps. With time tracking, scheduling, and attendance tools, you can keep overtime hours accurate and easy to report. No outdated spreadsheets or guesswork. Just clean data that helps with payroll, compliance, and even these new tax rules.

FAQ

Is overtime pay taxable?

Yes. Overtime earnings are still subject to payroll taxes like Social Security and Medicare. But starting in 2025, part of the overtime premium is eligible for the deduction under the One, Big, Beautiful Bill Act.

What is the new overtime deduction for 2025?

Workers can deduct up to $12,500 of qualified overtime compensation if filing single, or $25,000 if filing jointly. These deductions phase out at higher income levels.

Does the deduction apply to everyone?

It phases out for incomes over $150,000 ($300,000 for joint filers). Taxpayers must include their Social Security number on the return, and married couples must file jointly to qualify.

Will there be a tax break for overtime in future years?

Yes, the deduction applies for tax years 2025 through 2028 unless extended or changed by new legislation.

Do joint filers get special rules?

Yes. Joint filers can deduct up to $25,000 of qualified overtime compensation, but they must file together to claim the benefit.

Do state taxes follow this rule?

Not always. States can choose their own approach. Some may adopt similar deductions, while others may not.

Wasn’t there something called Trump’s no tax plan?

Yes. During President Trump’s term, proposals for “Trump’s no tax on overtime” circulated, but they never became law. The 2025 Act is the first time a federal overtime deduction has been enacted.

Who reports overtime pay to the IRS?

Employers and other payors must file information returns with the IRS and furnish statements showing the total qualified overtime compensation paid during the year.