Quality work sprouts from quality relationships. Respect, integrity, and honesty are the cornerstones to a mutually beneficial business relationship and therefore, we prioritize treating one another with these values in all our interactions. While we hold legal documents in high regard, the glue that keeps us together is the commitment to quality work and quality relationships.

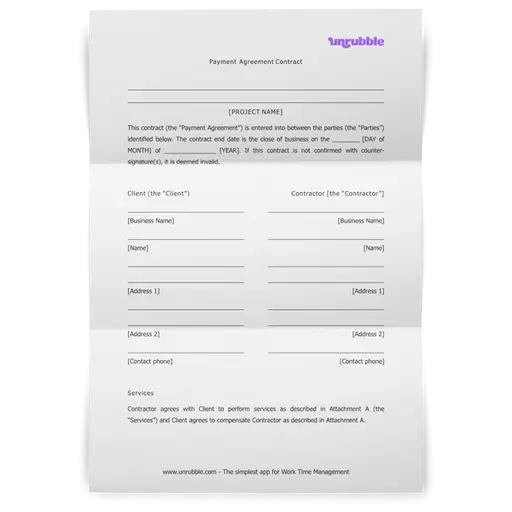

Here’s a sample Payment Agreement template that can be easily customized and adapted to meet your requirements. It’s free to download and use and can help you get your monthly payments in order.

Acceptances

Client agrees to assist Contractor in providing all that is required to complete Services within the time designated and in the format requested by the Contractor.

The contractor has the skillset and experience to complete all Services listed above and will complete the work within the timeframe identified. The contractor will work earnestly to the best of his/her ability to render Services in a timely manner and with a standard of excellence.

Warranty

Except as set forth within this contract, all deliverables are to be presented “as-is.”

Why is a payment agreement template important?

Whether it’s a simple payment agreement template or an installment payment agreement template that forecasts a host of payment dates, these contracts protect both you and the person or entity you’re entering into business with.

This type of contract, once agreed upon by both parties, commits the buyer of services to a payment plan, regardless if the services (or goods) are delivered as described. Essentially, you create a payment schedule that determines what happens when the payment plan agreement is breached because of late payments, what legal action should be taken and more.

This type of payment agreement template is also helpful when covering loan terms, as it clearly communicates to both parties what is expected out of the transaction. Expectations should be clearly outlined and defined, leaving no room for ambiguity, to prevent complications down the road.

What are the basics of payment agreements?

There are four basic steps to a payment agreement, however, Contractors and Clients are free to set their own terms.

- Requesting a deposit: You will find most Contractors request an initial good faith deposit to ensure the Client is serious about doing business and so the Contractor does not perform work for free under the legal contract. Usually, this is calculated as a percentage of the total project or any flat fee the Contractor designates. Almost every detailed payment plan agreement includes the actual payment method and how much the deposit should be.

- Work verification: Upon the start of a project, the Client should ensure the work is being performed as described by the service provider, confirming that the Services rendered are in line with what the contract states. If the work is being performed remotely, the use of online project management tools helps to ensure the project is underway and hitting milestones as scheduled. This gives legal protection to both parties in case of a breach of contract as there is legal proof that the work was completed.

- Installment payments: Contractors may request milestone payments as they move forward with the project, which is where an installment agreement comes in handy. This is particularly true when they are working a high-cost project, since the Contractor may have hired additional help that they need to pay for throughout the project’s duration, reflecting in the application of payments. This is also the case when the cost of materials is incorporated into the project total. As the Contractor uses materials, he or she may need additional funds to cover ongoing costs through to project completion. With milestone payments, the Client should ensure the work is being completed at each step through on-site visual inspection or through the use of project management tools which allow the Contractor to detail project progress. Depending on the method of payment, the client can set up automatic payments if the payment instructions are provided by the contractor.

- Final payment: Upon completion of services, the final payment for the project will be required. The Client should review the work conducted and ensure each portion of the Services, as described in the contract, has been completed. Once confirmed, the Client can make the final payment. To ensure IRS compliance and being safe in front of other financial institutions, the Client should supply the Contractor with a W-9 form for proper record-keeping. These payment terms are important for every party involved.

Can I use any payment agreement template PDF?

So long as the template allows you to clearly define expectations and list any necessary costs and terms, you can execute any template along with the other party to make it legally binding for a certain subject matter.

Even a simple PDF can expedite the payment process, establish the payment frequency and protect all the parties involved. You can choose your preferred file type above but bear in mind that PDF might work better on a mobile device, showcasing the entire agreement on one screen.

Conclusion

Payment agreements allow the Client and Contractor to clearly define a set of expectations, including the type of services performed or goods provided along with a billing schedule based on milestones or based on project completion. This upfront clarification between the two parties prevents misunderstandings and the potential for future disputes and missed payments.

Any type of agreement that involves finances should be protected with a payment agreement under default terms. Being proactive with the transaction allows both the Client and Contractor to practice their respective due diligence and complete the financial transaction. Professionalism with a legal document ensures each party feels comfortable moving forward and allows for a harmonious professional relationship.

Clients benefit from payment agreements because Contractors are required to clearly outline the scope of their work or goods, ensuring the Client gets exactly what he or she is paying for. This extra clarity makes it easy to follow up and ensure the work described in the contract is the work performed along the way and the work delivered upon project completion.

Contractors benefit from payment agreements because Clients are required to sign off on total costs, including materials and additional labor, ensuring Contractor receives full payment for any services or goods rendered. Setting a billing schedule also ensures Contractor has the means available throughout the project to continue work and meet the project deadline as promised.

The agreement covers the payment arrangements, the payment structure, and the time frame in which all the payment processes should be completed.

FAQ on payment agreement templates

If you have any doubts, check out the frequently asked questions.

How do I write a simple payment agreement?

Use a payment agreement template to simplify the process. Include the names of the two parties involved, the amount the debtor owes, the repayment schedule, and the associated payment plan. Clearly state the payment terms, payment method, and what happens if the debtor fails to make payments. Make sure the document is legally binding with a section on governing law.

How to write payment terms in an agreement?

In the payment agreement, outline the payment schedule, payment plan, and total amount due. Include the payment method (e.g., bank transfer, cash) and specify dates for each payment. State consequences if the debtor defaults on the payment, such as legal fees. Using a free payment agreement template can streamline the agreement process.

How to write an agreement for receiving money?

Use an agreement template to define the terms of receiving money. Include the two parties involved, the total amount, repayment schedule, and payment method. Mention what the debtor owes, the associated payment plan, and what happens if the debtor fails to make payments. The document should be legally binding and follow governing law.

How do you write a short agreement?

For a short agreement, use a free payment agreement template. State the two parties involved, payment terms, payment schedule, and the debtor's obligations. Include the repayment schedule and what happens if the debtor defaults. Keep it straightforward, but ensure the document is legally binding.

Can a payment agreement protect both parties?

Yes, payment agreements protect both parties involved. A legally binding payment plan outlines the repayment schedule, payment terms, and consequences if the debtor fails to meet obligations, avoiding disputes and potential legal fees.