Pay stubs, also referred to as wage statements and pay slips, detail the income information of your employees. Having a good pay stub template helps to ensure you are paying your employees properly and serves as a go-to guideline that outlines the structure required for a correct pay stub.

Below, we include information on the different types of pay stub templates you may need to use, we detail why a pay stub template is an important part of your business, and we list all the information that is required on pay stubs. Finally, we conclude with an explanation of why pay stubs are important for your employees.

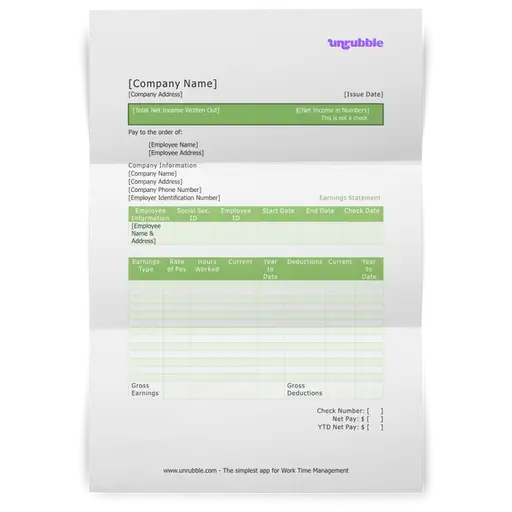

Here’s a sample Pay Stub template that can be easily customized and adapted to meet your requirements. It’s free to download and use and you can also upload it Google Docs and Google Sheets.

What is a pay stub template?

A pay stub template is a perfect way to keep your employee’s wage information itemized succinctly for each of their pay periods. A free pay stub template can help you track your employee’s income and includes the mandatory deductions for each pay period, such as state and federal taxes.

A free pay stub template with a calculator takes the labor and headache out of the process and assists you in creating error-free reporting. Instead of using a paystub generator to create a stub document, you can simply grab our paycheck stub template for free.

While you can create a pay stub template excel sheet, you can also obtain a printable pay stub template free that helps you stay on top of all your reporting requirements as an employer.

Each pay stub should include the details for the pay period along with tracking from year-to-date (YTD) payroll. Along with this information, a pay stub details the deductions taken from each paycheck, resulting in a clear outline of the total net income received by the employee.

Pay stubs can either be printed and mailed to your employees, or you can provide an electronic pay stub if you have set up direct deposit within your organization. You should keep a copy of your payroll stub for your own records, and your employee should also keep record of the pay stubs he or she receives throughout tenure with your company.

What are the different types of pay stub templates?

If you want to create an accurate pay stub without using a paystub generator, you need to choose the right paystub template for your needs. Based on employee details, time worked, overtime hours, whether they are salaried employees or contractors, their type of income and more.

Hourly wage employee pay stub template

When you hire hourly wage employees, you are responsible for itemizing their deductions, which include state, federal, and other mandatory deductions.

In addition, if your hourly employees are eligible for health insurance through your company, you are also responsible for correctly deducting their pre-tax payments toward their chosen health, vision, and dental insurance plans, along with any other supplementary plans you may offer.

The health insurance premiums and all other applicable deductions should be included in your sample pay stub.

Independent contractor pay stub template

Since independent contractors are responsible for tracking their own deductions, this type of paystub is significantly simpler and should just detail the type of work completed along with the total amount paid out to the third-party service.

Come tax time, you should prepare a 1099 for the independent contractor and submit that information to the IRS for your yearly reporting. Often, funds paid out to a third-party service for the continuation of business activities can be deducted as business expenses, which helps lower your total taxable income at the end of the year.

Spreadsheet pay stub template

Depending on the size of your organization, you may prefer to use a spreadsheet paystub to assist with the calculations of your employees’ wages and deductions. You can format and organize the data in a format that is easy to read.

Most professional pay stubs are created in a stub generator but you can create your own pay stub in minutes with our free but comprehensive paycheck stub template.

Document pay stub template

With the use of a word processor, you can create a vertical pay stub that contains the structure required. These types of pay stubs can easily be saved and reused as needed throughout your employee’s time working for your company.

You can print this out and use it as a paper pay stub too, for different reporting periods.

Electronic pay stub template

Electronic pay stubs are often a favorite for both employees and employers because of their ease of access. Generally, these are professional paystubs that are saved onto a payroll portal that your employee has a username and password for and for which you have admin control.

This is an especially convenient modern pay stub format that keeps you from having to reprint lost pay stubs. Employees can use this portal to view common deductions, retirement contributions, life insurance contributions, social security taxes, insurance coverage for their current period and more.

It's a digital document that allows both sides to keep electronic copies of relevant employee data, while at the same time speeding up the payroll process.

Why are pay stubs important?

Pay stubs are important for several different reasons, including accountability, transparency, and payroll compliance. With pay stubs, employees have the transparency that helps them understand how their wages are being paid out and what deductions are being taken.

Payroll errors happen even within the most stringent accounting offices and the transparency a pay stub provides helps your employees hold you accountable when an error is made. For example, if an employee worked overtime and the hourly rate wasn’t adjusted properly, the clear itemization on a pay stub helps an employee bring the error to your attention in a timely fashion.

Additionally, pay stubs are an efficient way of communicating with your employees, and prevents your human resources department from getting flooded with calls from employees wondering where their money is going.

They can have a single source of truth for their retirement plan contributions, an overview of their extra hours, income taxes, applicable deductions and more. If you need physical records of financial transactions and custom deductions, pay stubs are an excellent solution.

What information needs to be included on a pay stub template?

State employment laws dictate the specifics of what a pay stub should contain, so it’s important you check with your state to ensure you are meeting all reporting requirements, relevant payment calculations, employer contributions and more.

An online pay stub generator can help you to create a pay stub of your own, but a blank pay stub template is an excellent solution to create a proper pay stub without all that fuss.

However, there are some general pieces of information that every pay stub should include, such as:

Employee information

Include the name and address of your employee on every pay stub along with his or her social security number. You can also include other important identifiers in the employee details column, like their employee ID. For accounting reasons, this information should always be up to date. Good accounting software helps quite a bit here.

Dates of pay

This refers to the period your employee is being paid for. This could either be a weekly range or a bi-weekly range, depending on how often you pay your employees.

Gross wages

Gross wages are totaled when you multiply the rate of pay with the total hours worked. It does not include any deductions that are taken out from your employee’s paycheck.

The deductions column

Deductions include mandatory federal and state taxes, along with any other state-specific requirements, and any insurance, health savings accounts, or retirement savings plans your employee may have voluntarily signed up for.

Net wages

Net wages refer to the income received by your employee after all deductions have been processed. Every basic pay stub template should include this section.

Total number of hours worked

You should list the total number of hours worked, especially if your employees are paid by the hour. Regular time, overtime, and double time should be itemized separately on the pay stub.

Rate of pay (earnings column)

You should include the hourly rate of pay for hourly employees. For salary employees, you can take their annual salary and divide it by the total number of pay periods to determine their weekly salary.

If they have additional time for their payment period, these taxable wages should be covered here.

Why do employees require pay stubs?

Though not all states require you to provide your employees with pay stubs, you’ll find that most do. Pay stubs are required by employees for a variety of reasons, including providing proof of income for the following:

- Renting an Apartment

- Buying a House

- Applying for a Credit Card

- Applying for a Loan

- Accurate tax filing purposes

Each of these important milestones in the life of your employees requires proof of income and payment details for their salaries. As you know, these processes can be stressful on their own because of the amount of paperwork required.

Providing your employees with pay stubs facilitates this process and allows them to move into the next phase of their lives seamlessly. As an employer, keeping employees happy and moving forward is crucial, as a distracted employee can impact regular operations - and proof of income purposes are crucial for many administrative tasks.

In case you don't provide a pay stub for the current pay period, your employees may be tempted to create fake pay stubs with your company details, which could create massive problems for everyone involved.

Conclusion

Though as a business owner, you don’t receive your own pay stub, understanding the information required on pay stubs and why they’re helpful to both you and your employees is vital for your business. When you and your employees gain familiarity with the key pieces of information included on a pay stub, you can ensure accuracy and accountability, which makes paycheck issues a breeze to handle.

Discrepancies may cause underpayments and overpayments, which can create issues with IRS reporting. With a good pay stub template, you can prevent most payroll reporting issues and quickly catch any mistakes to keep all your payroll information in order.

All you have to do is grab the perfect pay stub template attached above and you'll have everything you need to get started.