Equity is important because it determines a company's ability to pay its debts and rewards shareholders, who are the people who own the company's shares. For private companies, equity is crucial for success.

Today, we're going to explain what equity is, show the common types of equity, and why it matters for the financial health of your business.

What is business equity?

Equity meaning in business: Equity is a term used in business to describe the total value of a company's assets. This includes everything, from the company's intellectual property to its physical assets. Equity is important because it represents the ownership of a company by its shareholders.

Shareholders are the people who own the company's shares. They are responsible for electing the company's directors and voting on company decisions. They also have a right to receive dividends from the company's profits.

For public companies, equity is the interest or residual interest that stays after deducting liabilities. Shareholders can buy stock from these companies in public markets, at the current market price.

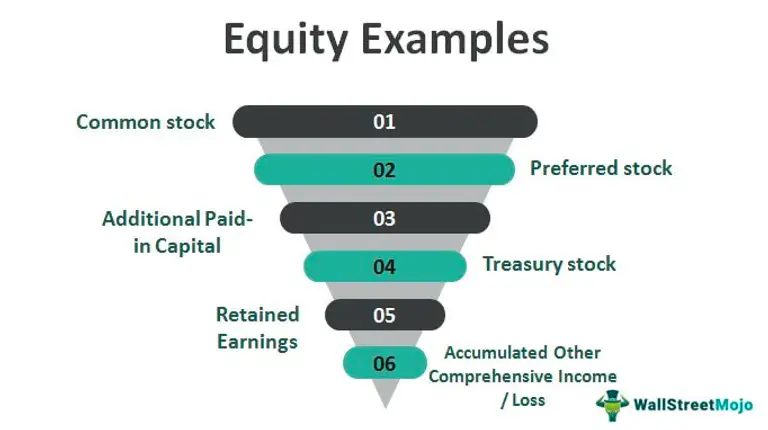

Seven types of equity

Equity is the amount of money that owners and shareholders invest in a company to get it started and keep it running. It also represents the value of a company minus its outstanding debt. Equity is one of the key metrics of financial health for public companies as well as those in the private sector.

Stockholders' equity

This is the portion of a company's assets that are owned by the shareholders. It can be positive equity or negative equity, depending on whether the company's assets are greater than its liabilities.

Acompany with a strong stockholders' equity position is typically better able to weather tough economic times and maintain a healthy balance sheet, which is crucial for equity investors.

Owners' equity

Also called ownership equity, it represents the residual value of a business's assets after liabilities are paid.

Owner's equity is an important part of a business's balance sheet. It can be used to finance a business's operations or expansion. Additionally, owner's equity can provide a source of collateral for loans.

Common stock

Common stock equity is one of the most important sources of financing for businesses. It represents the ownership interests of the shareholders in the company and can be used to finance a wide variety of business activities, from expansion and new product development to working capital and acquisitions.

While common stock equity does come with some risks, such as the potential for dilution of shareholder interests, it also offers a number of advantages, including the potential for significant returns if the company is successful. For these reasons, common stock equity is an essential part of most businesses' financing strategies.

Preferred stock

This is a type of equity that has certain privileges over common stock, but typically does not have voting rights. Preferred shareholders usually have priority over common shareholders in receiving dividends and in the event of liquidation.

However, preferred stock typically does not appreciate in value as much as common stock, so it may not be the best choice for investors looking for growth.

Retained earnings

This refers to the portion of a company's net income that is not distributed to shareholders as dividends. This money is reinvested back into the business and can be used to finance expansion, pay down debt, or for other purposes.

Retained earnings are important because they provide a source of funding for a company that does not need to be borrowed or raised from outside investors. This can help a company grow and expand without taking on additional debt.

Contributed surplus

This is the amount of money that is contributed to a company by its shareholders above and beyond the amount of money that is needed to purchase their shares. This surplus is typically used to finance the company's growth or to pay dividends to shareholders. While the concept of contributed surplus is simple, its implications can be complex.

Contributed surplus can have a major impact on a company's equity. Equity is the portion of a company's ownership that is held by its shareholders.

When a company has a large amount of contributed surplus, it means that its shareholders have a lot of equity in the company. This can be a good thing or a bad thing, depending on how the company is managed - with everyone being an equity holder.

Additional paid-in capital

Additional paid-in capital refers to the amount of money that shareholders have paid for their shares above and beyond the par value of the shares. This money is generally used to finance the company's operations and growth.

Paid-in capital is one of the key components of a company's financial strength and can give shareholders a sense of security about their equity investment.

Treasury stock

This equity is the portion of a company's ownership that is held by the company itself. This can be in the form of shares that have been repurchased by the company or shares that have never been issued.

Treasury stock equity gives the company the ability to control its own destiny, as well as giving it the ability to provide a financial buffer in times of need. While treasury stock equity can be a valuable tool for a company, it can also be a source of contention among shareholders.

How to calculate business equity?

In order to know how to calculate equity in business, it is important to first understand equity theory in business including the difference between stock and net worth.

Stock is a form of ownership in a company. When a company issues new stock, the new stockholders are entitled to receive a portion of the profits generated by the company. The value of a company's stock is based on the expected future profits of the company according to, for example, startup valuation services.

Net worth is a measure of a company's assets and liabilities. Net worth is calculated by subtracting the company's liabilities from its assets. Net worth is a good indicator of a company's financial stability.

There are two main ways to calculate business equity:

- Net worth method: The net worth method calculates business equity by subtracting the total liabilities of the company from the total assets of the company.

- Book value method: The book value method calculates business equity by subtracting the book value of the company's assets from the total value of the company's outstanding stock.

Both methods can be used to measure a company's financial stability. However, the net worth method is more accurate because it takes into account debt and other liabilities.

Once you have calculated business equity, you can use it to measure a company's performance. For example, you can use business equity to calculate a company's earnings per share (EPS).

Why is business equity important?

Business equity is important for a few reasons. The first is that it represents the value of a company for the equity holder. When a company is sold, the equity is what is sold. This is important because it determines the amount of money that the new owner can receive.

Equity also represents the stake that a company owner has in the company. This is important because it determines how much influence they have over the company. If a company owner owns a lot of equity, they are more likely to be supportive of building equity in a business.

Finally, equity is important because it determines the amount of money that a company can raise in a financing round. This is important because it allows the company to grow and expand, whether on private or public exchanges.

Wrapping up

The concept of equity is crucial to understand, whether you're looking to trade in the stock market or you want to purchase shares of stock in a private company. Positive equity is one of the top signs that a business is profitable and a good opportunity to invest in.