If you have never used a promissory note template before, you may be feeling a bit overwhelmed by the terminology and purpose of promissory notes and promissory letters.

To help, here is a look at what promissory notes/letters are, and how you can effectively use them as both a borrower and a lender.

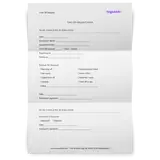

Here’s a sample Promissory Note template that can be easily customized and adapted to meet your requirements. It’s free to download and use. This article answers the basic questions on this type of document, but we should note that it is for informational purposes only. Consult a licensed attorney before signing anything.

What is a promissory note letter?

Promissory notes, oftentimes called promissory letters, are legally binding contracts that are more formal than a verbal agreement, but less formal than a standard loan from a bank. Typically, promissory notes are used in situations where family or friends are lending money to each other.

Secured vs. unsecured promissory notes

There are two common types of promissory notes: secured and unsecured, and you may be confused by the many promissory note samples for both.

To clarify, secured promissory notes are ‘secured’ or backed by some form of collateral – for example, a deed to a piece of property. On the other hand, unsecured notes are not backed by any form of collateral. Unsecured promissory notes are much riskier than secured promissory notes since the lender is not guaranteed to receive collateral in the event that the borrower is unable to pay back their loan.

The benefits of using a promissory note – for borrowers

For borrowers, there are many benefits of using a legal document such as a promissory note template. One of the main benefits being the fact that promissory notes enable you to still borrow money through personal loans – even if your credit score is bad.

Additionally, this private debt will not be reflected in your credit score, so newer businesses may find promissory notes particularly useful if they are not quite ready to take on ‘official’ debts just yet.

The benefits of using a promissory note – for lenders

Lenders can also benefit from using promissory notes. Given the high-risk nature of promissory notes, lenders can often charge an interest rate much higher than average and choose the repayment terms that suit them better to ensure they get money on time and avoid court-related costs should things go south.

Additionally, individuals or businesses who often loan money to friends or family members can make verbal agreements much more official with a promissory note. In some cases, lenders can also sell promissory notes for cash to debt collection agencies. However, this type of note will sell for much less than the principal value.

Best practices for using your promissory note template

Once you grab our template, it can help you with a repayment schedule, to handle your personal loans or issues with late payments. Here are some tips that can help you use this template in the best way possible, without involving a traditional lawyer in the process.

Only execute a promissory note with those that you trust

Promissory notes are much riskier than a typical bank loan. Therefore, it is highly recommended to only execute a promissory note with those that you trust. For lenders, that means those who will make their payments on time. And for borrowers, that means those who will not take them to court over a missed payment or charge outrageous late fees.

For example, if the borrower misses some installment payments and don't cover the entire balance, the lender can claim the rights of possession over motor vehicles, pieces of real estate and more.

Be extra specific about the terms in the loan agreement

Before crafting your own promissory note, always make sure to use a promissory note template as a starting point. These templates will have a place for all of the specific information that you should include in your note, including:

- Amount and interest of the loan

- Payment schedule

- Date for when the full payment is due

- Clause for what happens in the event of default

- Who covers the costs of collection

- Any additional terms

It is important to outline every detail about your agreement, and a promissory note template word document can help to ensure that you do not forget anything.

Never miss a payment

Promissory notes often carry with them interest rates that are much higher than standard loan rates from a financial institution. For borrowers, that means that it is critically important to never miss a payment on a promissory loan, as the interest owed will only increase. Not to mention you may also be hit with expensive late fees.

The late payment fee in the loan terms can be harmful to private parties, so think about making a lump sum payment early on to prevent paying the maximum interest rate possible, to prevent a law firm from getting involved.

Always keep an extra copy of the agreement on file

The terms outlined in promissory notes can sometimes get complicated. That’s why it’s always important to keep an extra copy of your promissory loan letter on file so that you can reference it when needed. This helps borrowers stay on top of their payments, and lenders can know the correct terms in the event of a missed or late payment.

Before signing, be aware of the associated risks

Before executing a promissory note with a friend, relative, or business partner, it is important for all parties to be aware of the associated risks that go beyond the late payment fee. This is a binding document and with the lender signatures on it, there is a legal framework in place that can protect the person lending the money.

Borrowers who sign a secured promissory note template should understand that their collateral (e.g. real estate) can be seized in the event of a default. Therefore, only take on the risk of a promissory note if you are sure that you will be able to pay the principal amount with interest.

Lenders should also be aware that there is a risk that the borrower may not be able to pay. Never lend an individual or organization more money than you are comfortable with losing in a worst-case scenario.

Myth Busting: Debunking Common Misconceptions About Promissory Notes

Promissory notes are crucial documents in loan transactions, yet they are often misunderstood. In this segment, we’ll address and clarify some common myths surrounding promissory notes, providing you with accurate information to enhance your understanding.

Myth 1: A Promissory Note and a Loan Agreement Are the Same Thing

Fact: While both documents are used in loan transactions, a promissory note is not the same as a loan agreement. A promissory note is a straightforward document in which the borrower promises to pay back the loan amount, often including details such as the interest rate and repayment schedule. In contrast, a loan agreement is more comprehensive, covering a wider range of terms and conditions agreed upon by both the borrower and lender. It may include clauses about what happens if the borrower defaults, attorney's fees, and other legal considerations.

Myth 2: If the Borrower Defaults, the Lender Cannot Enforce the Promissory Note

Fact: This is incorrect. If the borrower fails to make timely repayments as outlined in the promissory note, the lender can enforce the note through legal means. The promissory note outlines the terms under which the loan must be repaid, including the final payment due. If the borrower defaults, the lender can seek legal recourse to recover the amount owed, including accrued interest and possibly attorney's fees.

Myth 3: You Don’t Need a Lawyer to Create a Promissory Note

Fact: While it’s true that you can find a free promissory note template or a free promissory note online, it’s often beneficial to consult with a lawyer, especially for significant sums of money or complex loan transactions. A free promissory note might not cover all legal aspects necessary for your specific situation, potentially leaving gaps that could lead to disputes. A lawyer can ensure that the document includes all critical elements, such as the demand promissory note clause, interest rate specifics, and conditions for loan repayment, protecting both parties' interests.

Myth 4: Early Loan Repayment Is Always Beneficial for the Borrower

Fact: Although paying off a loan early can save on interest, it’s not always the best option for the borrower. Some promissory notes or loan agreements include prepayment penalties, which can negate the benefits of early repayment. Additionally, business loans might have clauses that affect the borrower’s financial flexibility or strategic financial planning. It’s essential to carefully review the entire agreement, including any clauses related to loan early repayment, to understand the full implications.

Understanding the nuances of promissory notes can prevent costly misunderstandings and ensure a smoother borrowing experience. Whether you’re using a free promissory note template or crafting a custom loan agreement, being aware of these myths and their factual corrections can help you navigate the complexities of borrowing money more effectively. Both the borrower and lender need to be well-informed to ensure a fair and transparent loan transaction.

![Keep Your Promises With This Promissory Note Template [Free Download]](/static/image?src=https%3A%2F%2Fcdnblog.unrubble.com%2Fpayload-unrubble-images%2FPromissory-Note-Template-600x600.png&width=512&height=512&fit=contain&position=center&quality=65&compressionLevel=9&loop=0&delay=100&crop=null&contentType=image%2Fwebp)