You'll find the download link for our blank invoice template at the bottom of this page. However, we'd recommend that before you skip to the end and get downloading, you should check out these 9 practical tips on how to use our blank invoice template to get paid promptly.

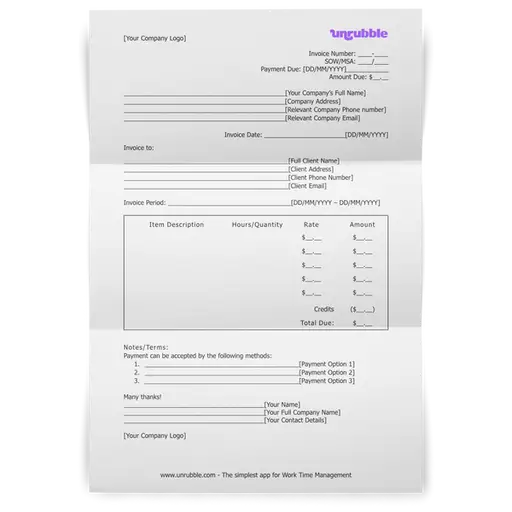

Here’s a sample Blank Invoice template that can be easily customized and adapted to meet your requirements. It’s free to download and use.

Using Your Blank Invoice Template to Get Paid: 9 Practical Tips

1. Outline your payment terms upfront in a contract

As a service provider, you get to set the rules, prices, and payment terms for your business transactions. That means that in your initial contract with each client, make sure to clearly outline:

- What services you will be providing

- How much they will cost

- When your client can expect to be invoiced and

- When payments are due

Letting your clients know about this information upfront is one of the best ways to make sure that there are no misunderstandings with your invoices in the future. Your clients will not be shocked when they receive one of your blank invoice templates with their name on it, and you will be more likely to be paid on time.

2. Separate invoicing and account management duties

After creating your own blank invoice template, you may also want to reconsider the process behind your invoicing. Remember, you want your account managers to foster good relationships with clients. However, having them be responsible for invoicing can oftentimes be awkward for the client and your staff.

If you have the budget, try to establish a separate department that is responsible only for invoicing or collections. This makes life much easier for your account managers.

3. Diversify your payment methods

Another great way to ensure you get paid is by diversifying your payment methods. By only accepting certain payment methods, you might be making it more difficult for your clients to pay. Try to find a payment processing service that is both flexible and accepting of a range of card types and currencies.

Once you have your payment methods established, make sure to update this information on your blank invoice forms that you keep on file. This may even need to be continuously updated and revisited as your business grows.

4. Experiment with various incentives

If you allow your clients to pay within 15 business days, some clients will inevitably leave it to the last minute to make their payment. However, if you need to increase your cash flow, you can always try to offer incentives for those who pay within 24 or 48 hours. Common incentives that may motivate clients to pay early include:

- Discounts on the invoice total

- Vouchers for future work

- Entries for a prize drawing

5. Send all invoices on time and on a schedule

Your clients are busy – and sticking with an invoicing schedule helps them to anticipate your invoices so that they can pay on time. With ongoing clients, you may want to consider only sending out invoices on a specific day of the month. For one-off projects, it is typically recommended to invoice at a minimum of 50% before performing any services.

This information should also be noted on your free printable blank invoice to make sure clients understand that they are only being invoiced for half of the work.

6. Automate follow-up emails

Once you have customized your blank invoice template in word and sent it off to your client for payment, you may want to consider setting up some automated follow-up emails. Again, your clients are oftentimes very busy and these follow-up emails act as a gentle reminder that payment has still not been received on your side.

Typically, follow-up emails are arranged to be sent 7 days, 3 days, and 1 day before the invoice is due. This can oftentimes be easily coordinated with your accounting software so that it can automatically send follow-up emails until a payment has been recorded.

7. Keep an open flow of communication with your client

Talking about late payments with your clients can be extremely uncomfortable for both parties involved. To make things easier, try to make sure that communication stays open and ongoing with your client. Clients will be much more willing to let you know about any financial troubles or issues if they trust you and have established rapport with you over time. This makes it much easier to find solutions to any potential payment problems that may arise down the road.

8. Always be courteous, concise, and honest

Not receiving payment on an invoice can be frustrating. However, it is important to always be courteous and honest with your clients when speaking to them about late payments. Oftentimes missed or late payments are either honest mistakes or misunderstandings, and you should never let that destroy a good business relationship.

That doesn’t mean you shouldn’t be assertive when following up on missed invoices, though. You can still be polite while also using concise language that lets clients know exactly how much they still owe you and when it is due. They will be much more motivated to pay if you are honest, professional, and clear about what is needed from them.

9. Keep Track of Best Practices and Processes

In the same file location where you store your blank invoice template pdfs, you should also include a folder dedicated to your company’s invoicing processes and best practices. This folder can serve as the basis for your invoicing policy while also providing a lifeline to struggling employees. Feel free to let this resource grow and adapt over time, and your employees will stay well-equipped for handling difficult clients and missed payments.

Myth busting: common misconceptions about blank invoices

Blank invoices are essential tools for businesses of all sizes, but several misconceptions can lead to misunderstandings and inefficiencies. Let's address and clarify five common myths related to blank invoices to enhance your understanding of this important financial tool.

Myth 1: blank invoices are only for large businesses

Clarification: Blank invoices are useful for businesses of all sizes, including small businesses. They provide a standardized way to bill clients, making the payment process more efficient. Whether you run a large corporation or a small local shop, using invoice templates can streamline your invoicing procedures and help ensure you receive faster payment.

Myth 2: you need special software to create invoices

Clarification: While invoicing software can offer advanced features, you don't need it to create professional invoices. There are many free invoice templates available in common formats such as Google Docs, Google Sheets, and Microsoft Word. These blank invoice templates are easy to use and can be customized to fit your business needs, allowing you to create invoices without investing in expensive software.

Myth 3: all invoice templates are complicated to use

Clarification: Not all invoice templates are complicated. Many free invoice templates and blank invoice templates are designed to be user-friendly and easily customizable. These templates come with fillable fields where you can enter your payment details, client information, and service descriptions, simplifying the invoicing process for small businesses and freelancers.

Myth 4: blank invoices cannot be customized

Clarification: Blank invoices can be highly customizable. Custom invoice templates allow you to add your company logo, change the layout, and include specific terms and conditions relevant to your business. This flexibility helps you create customized invoices that reflect your brand and meet your specific invoicing needs.

Myth 5: you have to create a new invoice each time

Clarification: You don't have to start from scratch each time you need to send an invoice. Using recurring invoices and invoice template formats, you can save time by reusing the same template for regular clients. This is particularly useful for service-based businesses that bill clients on a monthly or weekly basis. Many templates are available in pdf invoice templates, which can be simply downloaded and edited as needed.

By understanding these myths and the facts behind them, you can effectively utilize blank invoices to enhance your billing processes. Exploring different invoice template options and customizing them to your needs can lead to more efficient and professional invoicing for your business.