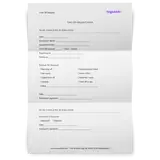

Free Loan Agreement Template

For your Loan Agreement you can use and download this free, print-ready template in Word (docs) or PDF. Bear in mind that this article is for informational purposes only and that it does not include legal advice.

What is a loan agreement?

A Loan Agreement is a legally binding contract that helps in defining the relevant terms of the loan and protects both the lender and the borrower. A loan agreement will help set the terms in stone and protect the lender if the borrower defaults while it helps the borrower follow the agreement terms such as interest rate and the repayment period.

Most loans, often personal loans are often done on a verbal understanding. This puts the lender at risk and many have often experienced the drawbacks of personal loan agreements. This highlights the importance of having a loan agreement handy and involved in the lending process. Not only is a loan contract legally binding but it also safeguards the lender’s money during the loan repayment period.

Another way to keep a personal loan agreement formal is to use a promissory note, which is a formal contract that outlines all the details, including the payment schedule, loan terms, penalty fees and more, without involving the notary public.

What does a loan agreement consist of?

Just like any legally binding contract, a loan agreement has certain terminologies that are sprinkled throughout the contract. These terms have their own purpose in the loan agreement and hence it is important to understand the meaning behind these terms while drafting or using a loan agreement.

Whether it's bank loans, or promissory notes, many of the terms stay the same as they are legal documents. Even a personal loan contract made with a loan shark is valid in the same way as a business loan taken from a bank.

Contact information

A loan agreement has the name and contact information of the borrower and lender, like all loan documents.

Repayment options

While drafting the loan agreement, you have to decide on how you want the loan to be repaid, i.e. the repayment terms. This includes the repayment date of the loan along with the payment method. You can choose between monthly installments or a lump sum amount for the repayment schedule.

Interest

With every loan, comes the interest. When it comes to a personal loan, if you don’t want any interest, the same has to be mentioned in the loan agreement. If you do want an interest then you need to mention how you want the interest to be paid and if pre-payment of the loan will come with any interest incentive or not. Specify this in the lending contract along with any other additional payment terms you may want to cover.

It can include the annual percentage rate in case of long-term loans, the minimum interest rate, variable rate, maximum usury rate, and any additional clauses related to interest.

Late fees and consequences of defaulting

Defaulting on a loan is a very real scenario, so is paying it back on a date later than the one that’s agreed upon. For this, you need to decide upon the agreeable ‘late payment’ date and the fees that come with it. In the case of a loan default, you need to define the consequences in front of the governing law, such as ownership transfer of the collateral or whatever is mutually agreed upon.

Collateral

Collateral is the borrower’s asset, a valuable item that they use to secure a loan from you. The loan agreement has to mention the item that is being used as collateral, this typically includes any real estate, vehicles, or jewelry. This is most commonly used in a promissory note, and the collateral is taken if the borrower misses their regular payments.

A loan that involves collateral is known as a secured loan, because in the cases of missed monthly payments or weekly payments, the lender can seize the collateral to collect the outstanding balance.

Cosigner

For those who don’t have a good credit history or if you don’t trust them with your money as they have a higher risk of default, a cosigner is brought into the loan agreement. A cosigner agrees to take over the loan payment if the borrower defaults. It's a way to keep the loan promises in cases such as lending money to family or friends.

FAQ on a loan agreement

Did some questions pop up in your head? Go through the FAQ, then.

How to write a simple loan agreement?

To write a simple loan agreement, include the loan amount, repayment schedule, interest payments, and any late fees. The borrower promises to repay the loan according to the agreed-upon terms. Ensure the entire agreement is clear, including what happens if the borrower fails to make loan payments. Unrubble’s loan agreement templates can help simplify this process.

What is the agreement to lend money to someone?

A loan agreement is a legally binding document where one party agrees to lend money to another. This includes personal loan agreements, where the borrower promises to repay the loan with or without accrued interest, depending on the terms. Loan agreements protect both parties during the borrowing money process, and you can easily draft one using Unrubble’s templates.

What is a short example of an agreement?

An example of a loan agreement might state: "The borrower promises to repay the loan amount of $5,000 with monthly payments. The loan will bear interest at 5%, with the final payment due in 12 months." This short format covers the essential loan agreement terms.

Can I repay a loan early?

Yes, many loan agreements allow for early repayment. If the borrower decides to repay the loan early, some agreements may include details about accrued interest and potential penalties. Be sure to check the loan agreement terms for any specific clauses related to early repayment.

How do payday loans work in loan agreements?

Payday loans are short-term loans that typically come with higher interest payments. The borrower promises to repay the loan amount by the next payday. If the borrower fails to do so, additional interest and fees may accrue. Loan payments for payday loans are often structured for quick repayment with clear terms in the agreement.

![Loan Agreement - Free Template (Word & PDF) [Download]](/static/image?src=https%3A%2F%2Fcdnblog.unrubble.com%2Fpayload-unrubble-images%2FLoan-Agreement-Template-600x600.png&width=512&height=512&fit=contain&position=center&quality=65&compressionLevel=9&loop=0&delay=100&crop=null&contentType=image%2Fwebp)