An income statement, along with your balance sheet and statement of cash flow is one of the three main financial statements that document the performance of your company over a specified accounting period. Income statements are also known as profit and loss (P&L) statements and are a vital part of your tracking process to keep your books in order.

A monthly income statement template can help you stay on track for quarterly and yearly reporting and an income and expense statement template can help you itemize your yearly revenue, expenses, and your net income. When you have a good template to use, you can stay on top of all your company’s internal operations, which puts you in the driver’s seat, allowing you to adjust your course in the most financially beneficial manner.

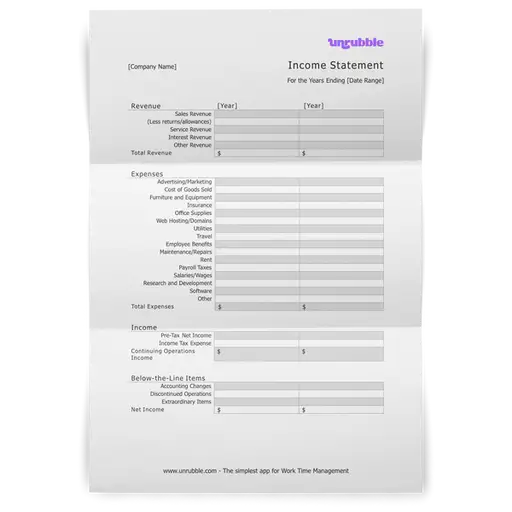

Here’s a sample Income Statement template that can be easily customized and adapted to meet your requirements. It’s free to download and use.

What Is an Income Statement?

An income statement is a document that provides clarity on your company’s operations, which includes how effective management is and what areas underperform and require adjustment for the next year of continued business. Think of it this way: without an income statement, you 1) have no defined trajectory to scale your business, 2) don’t know how to cut hindering losses that aren’t yielding profit, and 3) don’t know how to keep your business in line to meet future financial goals.

You can use a pro forma income statement template, for instance, to demonstrate your successful figures to investors and secure your forward momentum. Although these figures are more of a hypothetical assessment, they are a valuable visual representation that use your existing data for future projections.

Income statements consider the two most important financial aspects of your business: revenue and expenses. Revenue refers to the combination of both non-operating and operating profits while expenses refer to all the major and consequent activities that require management to keep your business operating successfully.

What Details Are Required in an Income Statement?

Keeping a balance sheet is important, but an income statement encapsulates both the financials over the course of a specified period, and it serves as a means of forecasting future revenue. There are two main components to an income statement:

1. Revenue

Revenue can be separated into two main categories: operating revenue and non-operating revenue. Operating revenue refers to the income you make through the primary operations of your business. For instance, if you manufacture or sell a product, then the income you receive from those primary activities constitutes operating revenue.

On the other hand, non-operating revenue is related to activities outside of your core sales objectives. That includes revenue from interest earned when your capital is held within your business banking institution for an extended period of time. Other examples of non-operating revenue include the rental income you receive for a business property or income received when you place ads for other businesses on your business property.

Gains is a third form of income that encapsulates any other income received that doesn’t fall under the regular revenue streams listed above. An example of gains is the income received following the sale of a company vehicle or van or the sale of unused land that previously belonged to your business.

2. Expenses

Expenses refer to the total cost for your business to continue operating. These costs can be written off, so long as they meet certain criteria, when you file your taxes. There are three categories for expenses.

The first includes your primary activities, like administrative expenses, research and development expenses, and software and equipment expenses. Also under the primary activity umbrella is expenses related to employees, like wages and sales commissions.

The second refers to secondary activities, like the interest you pay out on money borrowed. The third constitutes losses, which could be anything from legal fees associated with a lawsuit and rare or one-time costs.

It’s important to understand that income statements do not make a distinction between cash and non-cash receipts or cash and non-cash payments. It serves as a means to create a detailed flow that starts with revenue received, allows you to deduct expenses, and eventually helps you identify your net income. An income statement template excel sheet is a helpful tool to use for this purpose.

Why Is an Income Statement Important?

An income statement is an important document when you’re running a business because it gives you a detailed look at your company’s activities and provides you with the insight you need to keep moving toward operating in a profitable manner. When you have a detailed income statement in place, you and other key decision makers can pivot to increase sales, shut down a department that is not producing results, and even stop the sale of a product that is not generating the results that were initially projected.

The insights gleaned from a detailed income statement also provide a snapshot of the internal operations of your business, which provides you with the data you need to determine how competitive your business alongside other businesses in your industry. Without this data compiled neatly and clearly within an income statement template, you are essentially running your business blind, which hinders your potential for success.

Overall, maintaining an updated income statement puts you in control of the direction of your business, let’s you adjust company operations as needed to retain profitability, helps identify areas of your business that require improvement or that need to be cut altogether, and keeps you competitive in whichever industry you’re working in.